This letter is not part of the fund prospectus or offering documentation of VT Holland Advisors Equity Fund. Opinions expressed below are only those of the manager and shared for the interest of readers only. Qualitative terms like ‘great’ and ‘compounding’ are used only to explain the managers investing approach. Readers are instructed to look at the full disclaimers and fund prospectus.

Interim Investor Letter – June 2023

Dear Investors and Friends,

I hope this letter finds you well. The fund’s NAV year to date (i.e. calendar 2023) is up 27.7%*.

The period has seen a pleasing reassessment of the companies we are invested in, by our friend Mr Market. The fund is growing in size (now c.£16m) and I, its Investment Manager, continue to eat my own cooking – my family and I own c.18% of the units.

Investment approach

When we converted the fund to a UK UCITs structure in June 2021, I penned the following summary of our investment approach:

The rationale I use in investing remains steadfast. I try to buy the shares of businesses I think are set to offer us attractive long term compounding potential.

Usually, such businesses make good or great returns on capital and have strong competitive positions. Unusually, they may be hated (or disliked at least) by Mr Market at the time I make our purchase. This last point is perhaps what distinguishes our fund from others that might label themselves as having a ‘franchise’ approach. I share many of the same philosophies as ‘franchise’ investors, but instead consider myself as having a ‘compounding’ approach. The difference is perhaps subtle and one I hope that Mr Munger and many readers will understand.

Admiring great companies, I think is a perfectly reasonable activity. However, over time I think superior returns will be made by investing in such companies when they are priced either for failure, or at least for a fade in their growth, when in fact the business model is actually primed for success. The last key ingredient that goes into our not-so-secret mix is the Owner Manager. Almost always I am looking to invest alongside a CEO/founder/family who are aligned with us. They will have likely demonstrated past powerful compounding by managing and growing the business successfully for a long period through a variety of environments.

Whist readers should expect a degree of repetition in how I lay out the approach we use to invest the Fund’s monies, I also try to share with you my thinking and how it is evolving.

Sustainable Competitive Advantages (SCA’s)

In the December 2022 letter I discussed the investing bubble/whirlpool that had just ended. Whilst part of that bubble was directed toward technology shares (an echo of 1999/2000) a good part was also about the accepted ‘wisdom’ of following a GAAP strategy (Growth At Any Price!). Whilst this started maybe sensibly, as investors sought growth/returns when bond yields were so low, it ended up with a decent amount of folly.

Today I would make a few observations:

- I think the ability to independently value a company truly separate from its quote and without constant reference to discount/interest rates is now a very rare skill. From my study of Buffett and Munger I know they can do this. It is something I have worked incredibly hard to be able to do also. Because all investors can download the accounts and invest in the same shares there is an assumption the playing field is flat. I am delighted to say that I think it is not if an investor has this ability, knows what a great business looks like, and can control their emotions.

- I think the path to future long-term compounding one way, or another has to come from a business having some form of Sustainable Competitive Advantage – SCA (or Moat as Buffett described it). Coke’s brand or Visa’s network are easy to understand examples of this moat. So easy that Mr Market almost always values them efficiently. We don’t want to fish in these efficiently priced waters. That said we do still want to invest in businesses with great and identifiable SCA’s.

- I can highly recommend a book called 7 Powers, by Hamilton Helmer. It outlines seven SCA’s. Some like brands are obvious to all, others like Scale Economy Shared or Processing Power are less well understood.

By keeping our geographic and company size universe (small to very large) wide, we improve our chances of finding a new mispriced great compounding company. Broadening our definition of what we think defines a great business (i.e. under different SCA’s) widens that net further still.

Two new companies entered the portfolio early in the year as a consequence of this thinking. We undertook detailed work on both TSMC and Netflix. TSMC we concluded had powerful SCA’s in areas like Captured Resource but mostly in having a Processing Power unmatched by any peer in its industry. Netflix started life as a counter-positioning challenger to media industry incumbents, but this has now evolved giving it both Scale and Network economies. In both companies I was still looking for an Owner Manager mindset and value in our purchase price. For a company to be a holding we wish to retain for many years it needs to have a SCA. (NB: No Rules Rules by Reed Hastings gives a great insight into how Netflix is managed).

A word on growth – Good growth (organic) and bad (acquired)

The chart below shows the per share growth rate in the book value of Ryanair (Shareholder equity/Shares in issue). It also shows the same data point with any intangible assets/goodwill removed. Two things we hope stand out. The first is the consistency of growth over time, the second is the almost zero gap between the two measures. I have spent the thick end of 20 years formulating my investment approach so no single chart is going to fully encapsulate it. What this chart does however is give an idea of the sort of companies I am looking for. The speed of growth over time (steepness of the bars) will be determined by what returns on equity the company makes and what each year of growth requires in capital outlay. It will also show any reduction in the denominator (i.e. reduced shares in issue if any have been bought back with excess capital). The difference between the two metrics shows how much past capital generated has been allocated to non-organic growth.

In the case of Ryanair almost all of its capital has been deployed into purchasing the physical assets required for organic growth or buying shares back. A company, even one that has great returns on capital, that makes numerous acquisitions quickly sees these metrics diverge.

A large percentage of the companies we invest in have charts that look like the one below. Indeed, if you follow this link it takes you a selection of charts using the same metrics on a group of companies, we ether own or are attracted to. Why do so many companies we like have charts like this…..?

I like owner managed companies with a proven track records of growth and good returns on capital. I have also often repeated that I seek companies excelling at: Operate, Generate and Allocate, i.e. they are good at all three functions. The charts in the link provide a window into each companies’ past allocation of capital. As we are seeking out companies with good runways of growth, they should have ample opportunity to grow in their chosen field. If they are growing instead by acquired growth (which leads to the creation of intangible assets and goodwill) then this deployment of capital is likely outside core assets. Thus, it is higher risk.

There will always be exceptions to any rule, e.g. Berkshire Hathaway itself. And I repeat no single metric can capture my complete investment approach. I hope however this gives some insight as to why I am far more interested in some companies rather than others.

“When a company makes an acquisition, I buy two cards: a congratulations card and commiserations one. In five years’, time I decide which one to send” Warren Buffett

A word on our niche: Owner Managers – Enter Mark Zuckerberg

After a certain amount of experimentation with different value-oriented investing approaches I settled a few years ago on what I thought was the Fund’s niche. Seeking to invest in great owner managed companies when they were mispriced by markets. Whilst not 100% of our portfolio is invested in this way, it is certainly our biggest exposure and I would be very surprised if it does not stay that way for the foreseeable future. The reason for this is that I think I can understand (with a fair bit of work) some such businesses independently of Mr Market’s view. Also, I can see the extreme sentiment points other investors sometimes get to when their emotions get in the way of an objective assessment of value/likely compounding power. That statement suggests this process is easy – it definitely is not! However, being an outsider myself (comprehensive school, no degree, dyslexic, running a independent fund outside the M25), I find I can relate to the Owner Manager’s and the frustration they sometimes feel with the financial community. I do not however see my job as taking sides. Instead it is to be a rational assessor of a business’s quality, likely resilience and growth prospects, balancing these against the price it may be offered to us at when markets get nervous.

Meta vs Mr Market

Mispriced Owner Managers is an area I have written about in many research pieces and letters. In one such piece I made a strange comparison between Meta and Frasers. At first such a comparison seemed odd, even to me. As 2022 wore on it become more and more apt. Markets came to distrust all things Meta/Zuckerberg related and thus created a spiral of what I believe was irrational selling. Seemingly more and more shareholders felt they could no longer relate to the actions of the business owner they had once fully supported. Answerable to their fund management bosses for such ‘mistakes’ eventually the pressure (aka the looming career risk) was too great. Most sold out. In a November 2022 Holland piece on Meta (with the shares at $112) we noted the following:

Each investor likely has a different attitude towards how they react to bad news when it emerges from their companies. Some will sell early, and some will sell later during this psychological rollercoaster. Most sell. It is interesting to note that during such periods there is seemingly very little discussion about the underlying value of the business. This is arguably because investors are a) thinking with their fast-beating hearts and emotions, not their heads and b) deteriorating shorter-term profitability makes it look like the business is in freefall. Source: Holland Views: The Five Stages of Grief, November 2022

Portfolio changes in the period

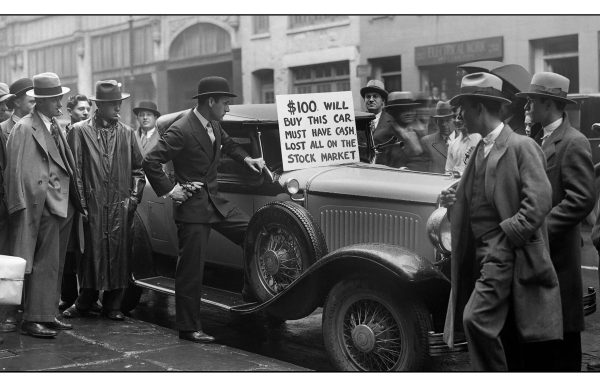

Much of what we achieved in this period had nothing to do with something clever done this year. Far from it. Instead it comes from the efforts made to invest in companies that were depressed during the 2020-2022 period. Or holding on to companies that got heavily marked down last year. This shows how important it is for ordinary investors to both stay invested for the longer term and also to keep calm when there is much noise/uncertainty around. Too many investors ‘buy’ when the economic and market outlooks are rosy and ‘sell’ when things look worrying. The net result is that their investment returns often significantly lag those of the indices. Where we can, we try to do the opposite as per Buffett’s advice below.

Be greedy when others are fearful, and fearful when others are greedy. Warren Buffett

We don’t always comment on every move in the portfolio, but a few changes are discussed below. Most of our holdings as of 30th June, were also in the portfolio at the start of the year. We made 4 outright sales and 5 new purchases. Two of those purchases were TSMC and Netflix. The later was bought for what we thought an interesting combination of factors. Firstly, I liked the long term Sustainable Competitive Advantage I thought evident when looking more closely at the company. The second factor was what I thought would be a near-term reveal of value as the company changed its attitude towards password sharing. I assessed its customer base (both those that pay and the 100m that don’t!) as super-sticky and knowing they had had a naughty bargain by sharing passwords for many years. I believe that if Netflix is sensible and customer focused on its roll out of charging more for those already using it for free, it will monetise its admired content further. We are pleased that this seems to be the case as news emerges out of the company. The shares are up c. 30% since our purchase earlier in the year.

Our sales included Boohoo, a mistake were we thought the capital could be better used elsewhere. Also Greggs and Youngs Non-Voting shares. Greggs is a company we like and might own again one day, but with lots of underpriced opportunities elsewhere in markets we decided to take our profits. The shares trade on c.26x earnings and whilst we think profit margins might one day increase as part of the group’s expansion plans, we don’t think that happens any time soon. Youngs Non-Voters shares were purchased during Covid due to the company’s strong owned pub estate, combined with the large discount the non-voting share traded at vs the ordinary shares. With beer/food prices kept high (not low) in Youngs pubs I was never a very comfortable owner of these shares. I also always had far more questions for management than got answers about how future capital generated by the group would be allocated. (See the organic vs acquired growth debate above). Post a rally in the non-voters share price, I decided to use the capital somewhere I had greater conviction.

During the period we were also quasi-forced to make some sales of successful investments like Meta and Greenbrick. This was because without doing so we would have breached our UCITS concentration rules (5,10,40) due to these investments performing so strongly. We find this a disappointing course of action to have to take, but rules are rules. When doing so we only tend to trim a holding to manage such situations. Our philosophy remains ‘buy right, sit tight’, as such we like to run our winning investments whenever we can. This was a period where many of our biggest investments rose strongly. Greenbrick shares were $24 at the start of 2023, today they are $56. Meta shares at 1st January were $120, today they are $300! Biglari ‘B’ shares started the year at $135 – they are now $202. Those looking at our Fund factsheet today will see will still have good sized exposure to all these companies. Frankly this quasi-forced selling is a nice problem to have, but it is an area we think regulation could be improved on a little. Maybe by giving managers a little more trust and leeway in how they manage their most successful investments post periods of outperformance.

The macro investing backdrop

At market turning points like those we have recently witnessed (i.e. in interest rates and sentiment) all investors become armchair economists. With professional economists less likely to be right than a coin toss, I do not feel inclined to join the debate. If pushed, I will admit that I think longer term interest rates will stay higher than maybe many believe. This I think is just a result of central banks seeing that very little economic expansion happened between 2-3% interest rates and 0%. Equally almost no contraction occurred when they moved from 0% to 2-3% either. As such with 0% interest rates making life so complicated in the last 15years, why would central banks return to that era? We have a couple of ‘float’ type investments in forgotten insurance companies that are brilliantly run and will do well in such a normalised interest rate world.

Otherwise, we would rather place bets where we think we have a better chance of winning, i.e. focusing on unloved well run, great compounding business. We try to buy them at moments when they are unloved and then try not sell them. With only a limited pool of capital, eventually we have to source new ideas by reducing older ones (or reversing mistakes) as per Greggs above.

I will sign off by sharing a piece of advice I picked up earlier this year: “In investing, if you can survive the first 30 years you should do just fine” Tom Gaynor, CEO Markel

Co-incidentally I have now been in active investing roles for almost 30 years, so hopefully I have served my apprenticeship. I love what I do and think with the framework we are using there are some wonderful opportunities ahead of us.

Thank you for your ongoing support.

With kind regards

Andrew Hollingworth, Fund Manager

21st July 2023

Fig.1: Ryanair’s book value/tangible book value per share

Source: Bloomberg

Source: Bloomberg

The information in this document is based upon the opinions of Holland Advisors London Limited and should not be viewed as indicating any guarantee of returns from any of the firm’s investments or services. The document is not an offer or recommendation in a jurisdiction in which such an offer is not authorised or to any person to whom it is unlawful to make such an offer. The information in this Report has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient and is published solely for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. In the absence of detailed information about you, your circumstances or your investment portfolio, the information does not in any way constitute investment advice. Potential investors should refer to the relevant Prospectus and Key Information Investor Document for full information. If you have any doubt about any of the information presented, you should obtain financial advice. Past performance is not necessarily a guide to future performance, the value of an investments and any income from them can go down as well as up and can fluctuate in response to changes in currency exchange rates, your capital is at risk and you may not get back the original amount invested. Any opinions expressed in this Report are subject to change without notice. Portfolio holdings are subject to change and the information contained in this document regarding specific securities should not be construed as a recommendation or offer to buy or sell any securities referred to. The information provided is “as is” without any express or implied warranty of any kind including warranties of merchantability, non-infringement of intellectual property, or fitness for any purpose. Because some jurisdictions prohibit the exclusion or limitation of liability for consequential or incidental damages, the above limitation may not apply to you. Users are therefore warned not to rely exclusively on the comments or conclusions within the Report but to carry out their own due diligence before making their own decisions. Authorised and regulated by the Financial Conduct Authority (UK), registration number 538932. All rights reserved. No part of this Report may be reproduced or distributed in any manner without the written permission of Holland Advisors London Limited. Investment Manager: Holland Advisors London Limited (registered number 538932), registered office 7 York Road, Woking, Surrey, GU22 7XH.